By Clara Summers, Campaign Manager

By Clara Summers, Campaign Manager

Consumers for a Better Grid (a project of CUB)

The electricity price for Illinois’ largest power utility, Commonwealth Edison, will go up significantly next summer because of a recent auction to secure reserve power. Grid operator PJM announced that its recent “capacity” auction sent prices skyrocketing from $28.92 per Megawatt-day to a record $269.92 per MW-day.

Such capacity costs make up a portion of the price of electricity, so this is expected to cause ComEd bills to increase starting in June of 2025.

Why are the prices so high? The Market Monitor for PJM said “the [] prices do not solely reflect supply and demand fundamentals but also reflect, in significant part, PJM decisions about the definition of supply and demand[.]”

But if supply and demand weren’t to blame, what was? Well, it’s complicated: There are multiple root causes–and each demonstrates a different failure of PJM leadership.

But just as the causes are in PJM’s hands, so are the solutions…

Root Cause 1: A Perfect Storm of Interconnection and Auction Delays

PJM’s capacity market is supposed to operate under a “three-year forward” mechanism. That means PJM holds auctions to buy reserve electricity three years in advance of when it’s needed. So when lower supply sparks higher auction prices, generators will then have ample time (three years) to respond to that signal and build new power plants.

Unfortunately, 2018 was the last time PJM held a three-year forward auction. Today, auctions happen on a drastically compressed schedule.

For example, PJM’s July auction secured reserve power for just 11 months into the future, June 2025–not enough time for new generating resources to build and connect to the grid.

That would be true even if PJM were quick to get resources online–but it’s not, and that’s the other problem. PJM is infamous for having one of the nation’s slowest interconnection queues. The “queue” is the waitlist for new electric resources seeking review and approval by PJM so they can be connected to the grid. Unfortunately, there are more renewable resources waiting in line than all of the resources currently powering PJM’s vast 13-state region.

As it processes this massive backlog, PJM isn’t renewing any new interconnection applications until 2026, at the earliest. Some projects have sat in the queue for so long (5 or more years) that they have lost financing or site permissions, and so they drop out of the process before PJM even reviews them.

In this frustrating situation–with a key part of the clean energy transition on hold–everyday electric customers will pay for higher capacity prices on their electric bills without getting any benefit for those payments. High prices + failure to get resources online quickly = bad news for ratepayers.

What does PJM need to do? Get back on schedule and bring more generation online.

First, PJM should fully comply with FERC Order 2023, which laid out new standards for interconnection processing. PJM has been foot-dragging on compliance, asking for exceptions to a number of these standards, including realistic treatment of battery storage, a technology that could be a huge help in easing these serious grid problems.

Complying with the Order will speed up processing in the long run–but, of course, PJM also needs to continue clearing out the existing backlog. And it needs a speedier process to transfer the ability to interconnect at a certain point in the grid–called Capacity Interconnection Rights (CIRs)–from retiring plants to new resources, so we can make the most efficient use of the grid. Right now, “stakeholders”–all the parties with interests in PJM, such as generators, transmission owners, consumer advocates, etc.–are evaluating a proposal to do just that. We hope the final proposal will not include any exceptions that allow resources to claim CIRs without using them, or monopolize them for an extended construction period.

There is an option that PJM stakeholders are not currently considering, but should: Reforms to PJM’s surplus interconnection process. Surplus interconnection allows multiple resources to use the same interconnection point and fill in when another resource isn’t performing. For example, a gas plant could share a connection with a battery, which means the gas plant could run less while the battery provides capacity. This is a key moment, and a creative solution like this should be on the table!

Root Cause 2: Bad Market Rules

PJM leadership doesn’t seem concerned about the high prices — indeed, they point to high prices as a signal that the market is working. But the Market Monitoring Unit (MMU), an independent watchdog to prevent market manipulation, has a different analysis: “Based on the data and this review, the MMU concludes that the results of the 2025/2026 [] Auction were significantly affected by flawed market design decisions…” There were a number of contributing factors, like recent changes to how PJM calculates resource risk and availability, and potential market manipulation via loopholes in the rules.

Speaking of flawed market design decisions, one of the major contributors to the high prices is the way PJM handles RMRs, or Reliability Must Run arrangements. RMRs allow PJM to keep an otherwise retiring plant in operation whenever they have concerns that a plant closure would hurt grid reliability. With a growing number of uneconomic coal and gas plants reaching retirement, RMRs keep polluting, expensive generators online well past their planned deactivation dates while replacement transmission is built. The whole point of RMR contracts is that the plant gets extra money to stay open — but PJM doesn’t consider them as available for the capacity market. Consumers thus end up paying double for an RMR: first for the price of the contract, and then again because of the high capacity prices that result from not counting the plant.

According to the Market Monitoring Unit, the way PJM handles RMRs resulted in a capacity price increase of over 40 percent!

What does PJM need to do? Fix the rules.

We joined other consumer advocates in sending a letter asking PJM to change the rules for handling RMRs, and several organizations have brought a complaint to FERC. Plus, we will continue pushing for alternatives to RMRs in a process CUB helped start this summer.

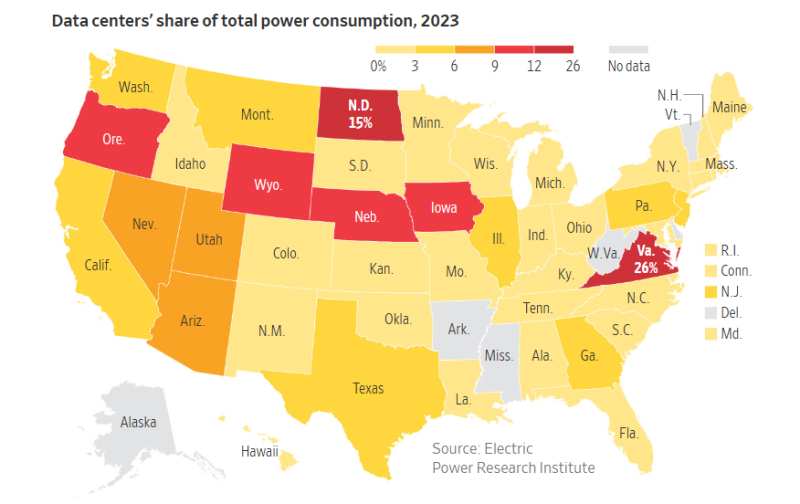

Meanwhile, we’re also seeing more challenges on the demand side. Requiring massive amounts of 24/7 energy, data centers are undeniably putting new strain on our electric system. PJM’s capacity market is intended to ensure there is enough electricity to meet our needs in the future. With the influx of new data centers being built, the grid operator is under pressure to make sure there is significantly more electricity available than previously. This can contribute to higher bills for ratepayers.

What does PJM need to do? Use accurate load forecasting

PJM uses load forecasts to determine how much electricity we need to buy in the capacity market. The load forecast is a projection of how much electricity demand there will be in the future. Since a load forecast determines how much electricity we’re on the hook for buying, it’s important to get it right! Unfortunately, PJM allows utilities to use wildly different assumptions and practices in determining their load forecast, which can drive up prices for consumers. A data center that has entered into a contract and put down money is much more realistic to include in a load forecast than a data center that may be shopping around for the best deal. We’ve called on PJM to institute more objective criteria.

We continue to find out how different factors impacted the capacity auction. It’s complex, but the aforementioned root causes are real. CUB will continue to advocate for new generation, rule changes, and load forecasting, and push for better as we uncover more details. The last auction was a failure for consumers. It must not happen again.

About the Author:

About the Author:

Clara Summers joined CUB in 2023. She heads the Consumers for a Better Grid (formerly CLEAR RTO) campaign, which advocates for a cleaner, more affordable power grid for the 65 million people served by PJM, the nation’s largest grid manager. Clara is based in the greater DC area. When not deep in the weeds of energy policy, she enjoys Irish dance, hammered dulcimer, and anything to do with koalas.