A record price spike in a recent electricity “capacity auction” means the supply price for Commonwealth Edison will likely increase significantly in June of 2025. Read CUB’s Q&A.

What happened?

On Tuesday, July 30, power grid operator PJM Interconnection announced the results of its latest capacity auction (technically referred to as the “Base Residual Auction”). This auction is how the grid operator secures reserve power in a vast region that stretches from the Midwest to the East Coast and includes northern Illinois’ ComEd territory.

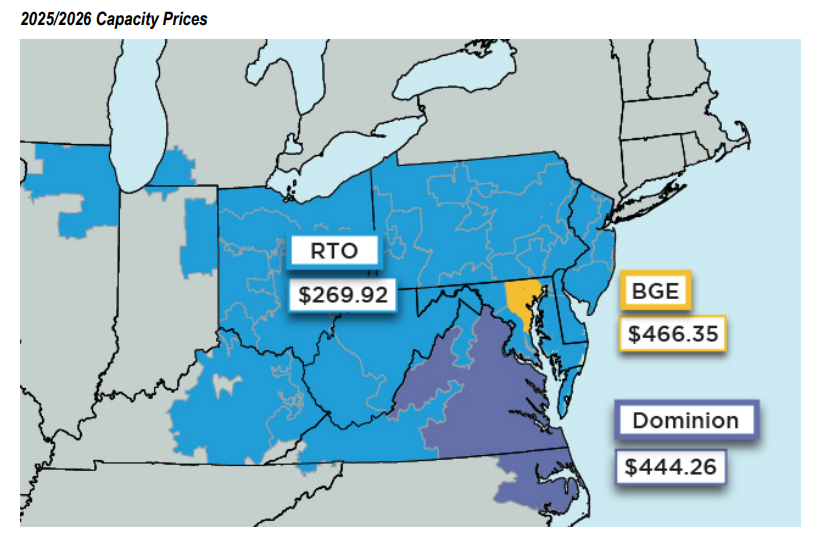

In the latest auction, covering the 12-month period from June 2025 through May 2026, prices for most of PJM jumped about 830 percent, from $28.92 per Megawatt-day in last year’s auction to a record $269.92 per MW-day. The prices were even higher in two eastern sections of PJM: The Baltimore Gas and Electric zone in Maryland ($466.35 per MW-day) and in the Dominion zone in Virginia and North Carolina ($444.26 per MW-day).

Not only was the capacity expensive, but the majority of it was dirty: PJM reported that 48 percent of the capacity power was supplied by gas generation and 18 percent by coal. Wind and solar were only at 1 percent each.

What exactly are capacity costs?

Not only do you pay for the power you use now, but you also pay for power you could use in the future. Capacity refers to extra payments consumers give power plant operators for the commitment to have enough reserve electricity available if demand suddenly spikes. (Think of a hot summer afternoon, when everyone blasts the AC.) The price for capacity for ComEd customers is determined through auctions run by PJM Interconnection–and the capacity price skyrocketed in the latest auction, in July.

Normally, PJM holds annual auctions to secure capacity prices three years in advance. But because PJM implemented reforms–in connection with its over-reliance on unreliable fossil fuel plants–the auction schedule has been thrown off and July’s auction set prices for next June.

Where does a capacity price increase appear on my bill?

An increase in capacity prices will affect the supply section of your ComEd bill. For most customers, capacity costs are buried in ComEd’s supply price–it’s one component of the price, accounting for roughly 20 percent of supply. The exception is if you’re an Hourly Pricing customer–then your capacity cost will be a separate line item on bills.

How much will an increase in capacity costs increase ComEd bills?

An 800 percent increase in capacity costs does NOT mean ComEd’s supply price is going up 800 percent. Capacity costs are only one part of what makes up the supply price. We caution you that the following are only rough estimates because there are still some unknowns:

- ComEd has told CUB it estimates that on June 1, 2025, its supply price–what it charges most residential customers for electricity–will increase by roughly 1.5-2.0 cents per kilowatt-hour (kWh) over the current supply price. (The current price is just under 7 cents per kWh.) Note: ComEd estimated the actual total cost of the capacity increase to be 2.35 cents per kWh. However, that increase is expected to be partly offset by a credit created by the Climate and Equitable Jobs Act (CEJA) (see below). The final price will also be subject to overall energy price changes.

- These are rough estimates, which can change in the months before these prices take effect, but a 1.5-2.0 cents per kWh increase would cost a customer who uses 500 kWh of electricity a month about $7.50 to $10.00 extra each month from June 1, 2025 through May 31, 2026. (More recently, ComEd told the Chicago Sun-Times the spike would increase average bills by an average of $10.50 a month.)

- The increase is bad news–but it could have been worse, if not for a provision in CEJA. CEJA created a line item on ComEd bills called the Carbon Free Energy Resource Adjustment (CFERA). The CFERA was designed to subsidize the carbon-free energy produced by Illinois nuclear power plants. But this adjustment becomes a bill credit when energy prices go above a certain level–as will happen on June 1, 2025. CUB and other consumer advocates pushed for this provision, arguing that if energy prices spike, the nuclear plants will earn more and don’t need the extra subsidy.

- What about Hourly Pricing customers, who have a capacity charge as a separate line item? Those customers will see their “multiplier” go up. (The capacity charge on an Hourly Pricing bill is the multiplier multiplied by a customer’s peak load usage.)

So who’s making money off this price spike?

Power generators–large corporations that own power plants, such as Constellation and Vistra, and sell power to utilities like ComEd–are making a killing. The online publication Utility Dive reported that the auction’s total cost to consumers jumped from $2.2 billion last year to $14.7 billion in the July auction. On the day the results were announced, the Constellation and Vistra stock price jumped about 11 percent and 14.5 percent, respectively.

ComEd is not making money off this price spike. The regulated utility passes supply costs–including capacity payments–onto consumers with no markup. (Note: ComEd does make money off another part of the bill–the delivery charges. ComEd raised delivery rates on Jan. 1 of this year. The upcoming increase in the supply price in the summer of 2025 has nothing to do with ComEd’s delivery rate hikes.)

Why did this happen?

PJM said the spike was due to decreased electricity supply and increased power demand (power-hungry data centers have been a key factor). Plus, PJM’s new market rules limit how much supply they take from plants that have suffered outages during extreme weather (such as unreliable gas plants). In 2023, PJM delayed the capacity auction to implement these new rules after Winter Storm Elliott caused a large number of plant outages–about 90 percent of them from gas and coal plants–and the grid operator came close to ordering rolling blackouts on Christmas Eve 2022.

But PJM’s “supply and demand” explanation is inadequate. For years, CUB, and other consumer advocates have criticized PJM for inaction and poor policy that relied too heavily on expensive, unreliable fossil fuels and raised electric prices for customers. “Once again, PJM has been slow to adapt, and electric customers will (again) pay the price,” CUB said in a statement after the latest capacity price spike.

Specifically, CUB said the spike was caused by PJM’s foot-dragging on fixing a clogged interconnection queue and implementing long-term policy to build cost-effective transmission–which has prevented more clean energy generators from coming online. Also, CUB has long said the capacity market doesn’t work for consumers, because the way PJM decides how much capacity is needed gives big payouts to generators at the expense of consumers. CUB has been so concerned about increased bills and other consequences of bad PJM policy that the consumer group launched its Consumers for A Better Grid campaign to push for reforms.

What reforms is CUB working for to prevent a spike like this happening in the future?

Key reforms PJM should implement:

- Speed up the interconnection queue. That’s the line of mainly clean energy power generators waiting to be brought online (connect to the grid) so they can produce power and help bring prices down. The Lawrence Berkeley National Laboratory reported that there were 3,309 active projects worth about 290 gigawatts of electricity waiting to connect to the grid at the end of 2023–enough to power the entire PJM region. Unfortunately, these projects wait so long for final approval in PJM’s queue that many are in danger of never getting built. “(PJM) has unnecessarily set our transition to cleaner energy back by years,” Clara Summers, CUB’s Consumers for a Better Grid campaign manager told the Tribune. In its Generator Interconnection Scorecard, clean energy business group Advanced Energy United reported that PJM came in last out of seven regions, with a grade of D-. In reaction to the price spike, Advanced Energy United said: “PJM didn’t prepare for an energy transition we all saw coming, and now consumers are going to pay the price.”

- Implement long-term transmission planning. The Federal Energy Regulatory Commission (FERC) recently came out with a new rule, Order 1920, for how to plan transmission. If implemented properly, the FERC rule could be a big step toward securing clean, affordable energy for consumers. Unfortunately, PJM is dragging its feet, and has asked FERC for a rehearing of some of Order 1920’s provisions. (Read more in CUB’s WatchBlog.)

- Improve load forecasting. CUB and other consumer advocates wrote a letter to PJM, expressing their concern that inaccurate forecasting of future electricity load will lead to higher costs for consumers.

- Implement state reforms. With PJM’s foot-dragging, it is important for Illinois legislators to continue to take steps to strengthen the power grid, including passing the Clean and Reliable Grid Affordability (CRGA) Act (SB2473/HB3779). This proposal would reduce stress on the power grid by updating energy efficiency standards for ComEd, Ameren and large industrial customers; create new opportunities for residential customers to take part in demand-response plans that help lower demand by shifting their energy use to off-peak hours; and help accelerate clean energy resources that are essential to keeping the power on even during extreme weather.

In general, PJM relies too heavily on fossil fuels. “For years, the largest grid operator in the eastern U.S. has all but refused to diversify its resource mix and bring new energy online, and instead opted to depend excessively on an aging fossil fuel fleet while ignoring its reliability failures,” NRDC said. “This sticker shock is a direct result of recent regulatory changes made to address those reliability failures.”

How can ComEd customers try to lessen the impact of the supply price increase?

Some steps you can consider to lessen the impact.

- Contact your utility. If you are having trouble affording your energy bills, it is vital that you contact your utility. Ask if you qualify for any energy assistance programs; see if you can set up a payment plan to give you a longer time to pay off your bills; and inquire about no or low-cost energy efficiency programs the company offers. Also, see if you qualify for energy assistance that will be offered again in the fall. To learn more about the Low Income Home Energy Assistance Program (LIHEAP), visit www.helpillinoisfamilies.com or call the Help Illinois Families Assistance Line at 1-833-711-0374.

- Practice energy efficiency at home. For tips and information about helpful ComEd energy efficiency programs, visit CUB’s Clean Energy page and ComEd’s energy efficiency page.

- Consider a community solar deal to help ease costs. Community solar offers currently guarantee savings compared to the utility’s supply price. But be a careful shopper: Get more information at our special website, SolarInTheCommunity.com.

- If you’re interested in installing solar panels, now might be a good time to move forward. Learn more about the Solar Switch program, which CUB participates in, and rooftop solar in general. Also, there is an excellent program for income-qualified customers interested in solar called Illinois Solar for All.

- Don’t panic. Alternative supplier sales representatives pitching you via door-to-door, phone or mail marketing may try to use this impending price increase to lure you into a bad deal. Be careful, and remember that alternative supplier prices will also go up because of this development. (A lot of people have lost money with alternative suppliers over the last decade, as CUB recently reported.) If your community has a municipal aggregation deal, see what price it’s offering and if it can protect you from the ComEd supply price spike in June of 2025. Depending on the term of the community power deal, it might be able to secure savings–but don’t assume that. Ask what price the community deal offers and for how long. See CUB’s fact sheet on community power deals, and see this list of community deals from the ICC.

Are Ameren Illinois customers impacted by this?

No. Ameren Illinois’ market is run by a different power grid operator, called the Midcontinent Independent System Operator, or MISO. The capacity auction that would impact Ameren’s supply rate in June of 2025 won’t happen until next spring.