A record price spike in an electricity “capacity auction” means the supply price for Commonwealth Edison will increase significantly on June 1. ComEd estimates this could cost customers an extra $10.60 per month, on average. Read CUB’s Q&A and visit CUBHelpCenter.com for more information.

What happened?

Last summer, power grid operator PJM Interconnection announced the results of its latest capacity auction (technically referred to as the “Base Residual Auction”). This auction is how the grid operator secures reserve power in a vast region that stretches from the Midwest to the East Coast and includes ComEd’s territory in northern Illinois.

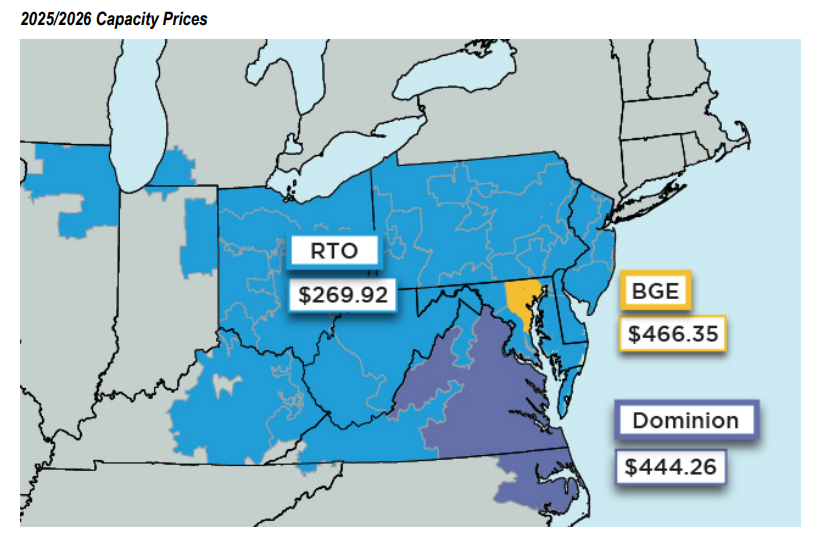

In the last auction, covering the 12-month period from June 2025 through May 2026, prices for most of PJM jumped about 830 percent, from $28.92 per Megawatt-day in last year’s auction to a record $269.92 per MW-day. The prices were even higher in two eastern sections of PJM: The Baltimore Gas and Electric (BGE) zone in Maryland ($466.35 per MW-day) and in the Dominion zone in Virginia and North Carolina ($444.26 per MW-day).

Not only was the capacity expensive, but the majority of it was dirty: PJM reported that 48 percent of the capacity power was supplied by gas generation and 18 percent by coal. Wind and solar were only at 1 percent each.

What exactly are capacity costs?

Not only do you pay for the power you use now, but you also pay for power you could use in the future. Capacity refers to extra payments consumers give power plant operators for the commitment to have enough reserve electricity available if demand suddenly spikes. (Think of a hot summer afternoon, when everyone blasts the AC.)

Normally, PJM holds annual auctions to secure capacity prices three years in advance. But PJM got off schedule years ago and July’s auction set the capacity price for the following June, only 11 months in advance. This compressed auction schedule has contributed to PJM’s problems.

Where does a capacity price increase appear on my bill?

An increase in capacity prices will affect the supply section of your ComEd bill. For most customers, capacity costs are buried in ComEd’s per-kilowatt-hour (kWh) supply price–it’s one component of the price, typically accounting for roughly 20 percent of supply. (The exception is if you’re a customer of ComEd’s Hourly Pricing program–which charges you a supply price that can change hourly. Hourly Pricing customers see capacity as a separate line item on bills.)

How much will an increase in capacity costs increase ComEd bills?

ComEd has not yet announced its summer electricity price. An 800 percent increase in capacity costs does NOT mean ComEd’s supply price is going up 800 percent. Capacity costs are only one part of what makes up the supply price–the final ComEd price will also depend on overall energy price changes. We caution you that the following are only rough estimates:

- ComEd’s current supply price is just under 7 cents per kWh, and its new price on June 1 will be 10.028 cents per kilowatt-hour (kWh). ComEd says the spike would increase bills by an average of $10.60 a month, or 10 to 15 percent, but the actual increase could run a lot higher depending on actual usage.

- Hourly Pricing customers, who have a capacity charge as a separate line item, will see their “multiplier” go up. (The capacity charge on an Hourly Pricing bill is the multiplier multiplied by a customer’s peak load usage. Read more here about how to figure your capacity charge.)

How is the Climate and Equitable Jobs Act (CEJA) providing some relief for ComEd customers?

The cost increase is expected to be partly offset by a credit created by Illinois’ landmark energy law, the Climate and Equitable Jobs Act, or CEJA. The law required a line item on ComEd bills called the Carbon Free Energy Resource Adjustment (CFERA), which was designed to subsidize carbon-free energy produced by Illinois nuclear power plants. But, under a provision pushed by consumer advocates, this adjustment becomes a bill credit when energy prices go above a certain level, such as during this spike. For example, that credit is about 1.7 cents per kWh in June. So the impact of the price spike would have been much worse without the CEJA credit.

Note: Solar customers who participate in net metering won’t get this credit on their bills. According to ComEd, the “credit or charge for net metering customers is the reverse of what it is for other customers.” So, if standard customers receive a credit, net metering customers receive a charge, and vice-versa. This has to do with the fact that solar customers are generating their own power. Solar is an excellent deal, especially at times like this. We never like to see a charge added to bills, but even with the charge, homes with solar panels should enjoy net savings during high-priced times like this.

So who’s making money off the price spike?

Power generators–large corporations that own power plants, such as Constellation and Vistra, and sell power to utilities like ComEd–are making a killing. The online publication Utility Dive reported that the auction’s total cost to consumers jumped from $2.2 billion last year to $14.7 billion in the July 2024 capacity auction. On the day the results were announced, the Constellation and Vistra stock price jumped about 11 percent and 14.5 percent, respectively.

ComEd is not making money off this price spike. The regulated utility passes supply costs–including capacity payments–onto consumers with no markup. (Note: ComEd does make money off another part of the bill–the delivery charges–and CUB challenges those increases before the Illinois Commerce Commission [ICC]. However, this supply price spike has nothing to do with ComEd’s delivery rate hikes.)

Why did this happen?

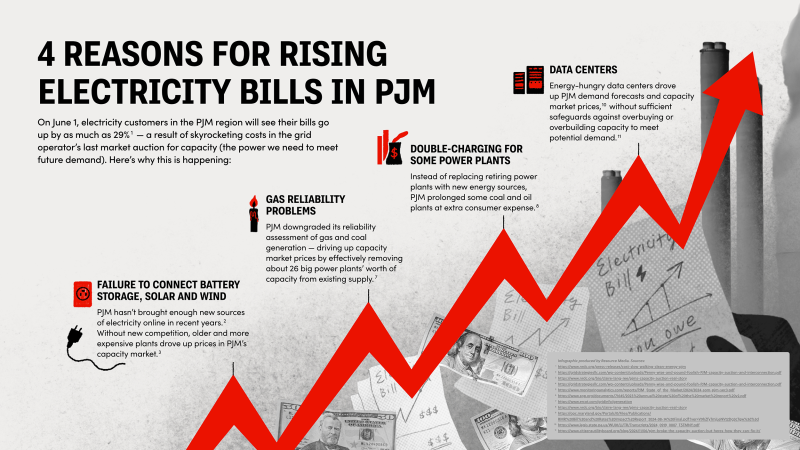

There are a number of reasons, but CUB says the main driver of the price spike is inaction and poor policy by PJM, which relies too heavily on expensive, unreliable fossil fuels. A summary of the root causes of the price spike:

Poor PJM Policy: The grid operator has been slow in implementing long-term reforms to build cost-effective transmission and more efficiently connect clean energy generators to the grid. PJM has one of the nation’s slowest “interconnection queues” — the waitlist for new power plants seeking review and approval by PJM so they can provide electricity and help bring down prices. Unfortunately, there are more renewable resources waiting in line than all of the resources currently powering PJM’s vast 13-state region. Some projects have waited so long for PJM review (5 or more years) that they have lost financing or site permissions, and will never get built.

Poor Market Rules: PJM’s Market Monitoring Unit (MMU), an independent watchdog to prevent market manipulation, has said the capacity auction results “were significantly affected by flawed market design decisions.” For example, RMRs, or Reliability Must Run arrangements, were a major contributor

to the high prices. RMRs allow PJM to keep a retiring plant in operation longer if it’s concerned the closure would hurt reliability. Here’s the problem: While RMR contracts give an outdated power plant extra money to stay open, PJM doesn’t count them in the capacity market. So consumers pay double for an RMR: first for the price of the contract, and then again due to the high capacity prices that result from not counting the plant. This RMR policy increased capacity prices by more than 40 percent, the MMU said.

(Another contributor: New market rules limit how much supply they take from plants that have suffered outages during extreme weather–such as unreliable gas plants. In 2023, PJM delayed the capacity auction to implement these new rules after Winter Storm Elliott caused a large number of plant outages–about 90 percent of them from gas and coal plants.)

Poor Load Forecasting: No doubt, energy-guzzling data centers are straining the electric grid, but PJM needs to better manage this challenge. For example, the grid operator uses “load forecasts” to project future demand and determine how much electricity we need to buy in the capacity market. But PJM allows utilities to use wildly different approaches to determining their load forecast, and that can drive up prices for consumers. Too often a proposed data center is included in the load forecast even if it has little chance of actually being built.

For a more detailed explanation of the root causes, read CUB’s blog: PJM broke the capacity auction–but here’s how they can fix it. Concerned about high bills and other consequences of bad PJM policy, CUB has launched its Consumers for A Better Grid campaign to push for reforms.

What reforms should PJM implement to prevent future price spikes?

CUB calls on PJM to launch the following reforms:

- Speed up the interconnection queue. That’s the line of mainly clean energy power generators waiting to be brought online (connect to the grid) so they can produce power and help bring prices down. The Lawrence Berkeley National Laboratory reported that there were 3,309 active projects worth about 290 gigawatts of electricity waiting to connect to the grid at the end of 2023–enough to power the entire PJM region. Unfortunately, these projects wait so long for final approval in PJM’s queue that many are in danger of never getting built. The Federal Energy Regulatory Commission (FERC) came out with a rule to speed up interconnection queue processing—Order 2023—in 2023, but PJM still refuses to comply. A new report by Synapse Energy Economics found that reforming the PJM interconnection queue process would cut the average household’s energy bills by $505 per year.

- Improve load forecasting. CUB and other consumer advocates wrote a letter to PJM, expressing their concern that inaccurate forecasting of future electricity load will lead to higher costs for consumers.

Another key reform: Implement strong state policy. With PJM’s foot-dragging, Illinois must continue to take steps to strengthen the power grid, including passing comprehensive energy legislation to implement a number of commonsense, pro-consumer clean energy policies that emphasize affordability and sustainability. That includes expanding cost-effective energy efficiency, battery storage and other programs that help cut electricity demand, reduce prices and strengthen reliability.

How can ComEd customers try to lessen the impact of the supply price increase?

Some steps you can consider to lessen the impact.

- Contact your utility. If you are having trouble affording your energy bills, it is vital that you contact your utility. Find out if you can set up a payment plan to give you a longer time to pay off your bills; and inquire about no or low-cost energy efficiency programs the company offers. Also, consider signing up for ComEd’s Peak Time Savings program, which gives residential customers the opportunity to earn small bill credits by reducing electricity usage during times of high electricity demand, typically summer afternoons.

- See if you qualify for energy assistance. ComEd has announced a $10 million Customer Relief Fund for income-qualified customers starting July 7. Visit www.comed.com/relief to see if you qualify. (You can also see if you qualify for the Low Income Home Energy Assistance Program [LIHEAP], but please know that assistance is no longer available in several counties because available funding has been used up. To learn more about LIHEAP, visit www.helpillinoisfamilies.com or call the Help Illinois Families Assistance Line at 1-833-711-0374.)

- Practice energy efficiency at home. For tips and information about helpful ComEd energy efficiency programs, visit CUB’s Clean Energy page and ComEd’s energy efficiency page. Also, read our blog: Tips on fighting high summer electric bills.

- Consider a community solar deal to help ease costs. Community solar offers currently guarantee savings compared to the utility’s supply price. But be a careful shopper: Get more information at our special website, SolarInTheCommunity.com.

- If you’re interested in installing solar panels, consider the next steps. Learn more about the Switch Together program, which CUB participates in, and rooftop solar in general. Also, there is an excellent program for income-qualified customers interested in solar called Illinois Solar for All.

- Beware of bad alternative supplier deals. Alternative supplier sales representatives pitching you via door-to-door, phone or mail marketing may try to use this impending price increase to lure you into a bad deal. Remember: Alternative supplier prices will also go up because of the increase in capacity prices. Illinois electric customers have lost about $1.8 billion to alternative electric suppliers over the last decade. Even in this market, it’s likely ComEd is your best bet for electricity supply. One possible exception: If your community has a municipal aggregation deal, see what price it’s offering and if it can protect you from the ComEd supply price spike. Depending on the term of the community power deal, it might be able to secure savings–but don’t assume that. Ask what price the community deal offers and for how long. See CUB’s fact sheet on community power deals, and see this list of community deals from the ICC.

Are Ameren Illinois customers impacted by capacity prices?

Yes. Ameren Illinois’ capacity market is run by a different power grid operator, called the Midcontinent Independent System Operator, or MISO. The prices in MISO’s auction also have skyrocketed.